With everything happening in the world and the markets right now I’ve had clients consistently inquiring about their pension plans. While I’m obviously a recruiter and not a financial advisor, I have done a fair amount of research on the subject. I decided to create this post in the hopes of helping out some of my curious AT&T clients.

Whether you’re changing jobs or retiring from AT&T, knowing what to do with your hard-earned retirement savings can be difficult. An employer-sponsored plan, such as a Pension & 401(k), may make up the majority of your AT&T retirement savings, but how much do you really know about that plan and how it works? There are the seemingly endless rules that vary from one retirement plan to the next, early out offers, interest rate impacts, age penalties, & complex tax impacts.

Increasing your investment balance and reducing taxes is the key to a successful retirement plan spending strategy.

“Workers are far more likely to rely on their workplace defined contribution (DC) retirement plans as a source of income. 8 in 10 believe this will be a major or minor source of income in retirement. 3 in 4 expect income to come from their personal retirement savings or investments.”

– Employee Benefit Research Institute

“Anyone nearing retirement should know his or her number. That is, how much you need saved to retire.“

As of March 2018, 77% of full-time private-sector American workers had access to an employer retirement plan, but only 61% chose to participate. Regardless of what you choose to do with the funds from your employer retirement plan, you’re already ahead of 39% of all workers.(1)

AT&T History

AT&T has a complicated history of breaking up and merging back together. In 1984 the giant corporation was split into regional telecommunications companies known as the “Baby Bells.” Since the break-up, these companies have merged once again to form the present-day AT&T.(1) Due to AT&T’s mergers, understanding the complexities of the pension plans can be a challenge.

Service Pension Eligibility & Calculation

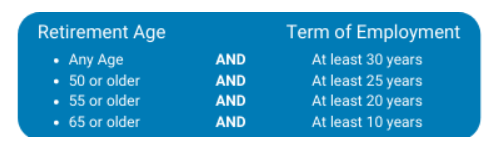

AT&T relies on the “modified rule of 75” to determine an employee’s retirement eligibility, pension, and retiree medical benefits.

Anyone nearing retirement should know his or her number. That is, how much you need saved to retire. As an AT&T employee nearing retirement, there’s another important number to know. You could say it’s just as important as the target amount you plan to save in your AT&T 401(k) plan to help supplement your AT&T pension. The number is 75, and it can greatly impact your AT&T retirement benefits.

Other Important things to know: In 1999, SBC changed 75 pt to Mod 75. Remember after December 1999 not every combination of 75 points gets you qualified.

How it Works: You are eligible for a vested pension benefit after five years of service, but your benefit will be negatively affected if you do not reach the age AND service breakpoints for your employment position, as shown in the chart below. You must meet BOTH minimum requirements.

For example, let’s assume you have 24 years of service and are age 51. Although the combination adds up to 75 (24+51=75), you do not qualify because you fail to meet both minimum requirements at each break point.

For AT&T management employees who meet the 75-point rule but don’t have 30 years of service, their pension benefit will be reduced if taken before age 55.

Service Pension Eligibility & Calculation

If you do not meet the 75-point rule yet and are pension eligible (5 years of service), you will receive your earned AT&T pension at age 65. Taking it prior to age 65 will result in a significant reduction.

Further, employees who satisfy the modified rule of 75 may be eligible for subsidized retiree medical, dental, vision and life insurance benefits.

Note: If you’re are a union employee with 30 or more years of service, however, the pre-55 reduction does not apply.

If you are currently a manager and you began your career as a Craft employee, you will actually have two pension accounts. When you retire, you will be able to draw from both pensions. We’ll talk about the inner-workings in the bridging section a little later.

The Craft pension is simply based on your pension band, NCS, and any age penalties. The pension band used to calculate your benefit will be that which you are in at the end of your career. Again, Fidelity will give you the easiest way to calculate your projected benefit although we can also do it manually to compare the results.

Lastly, if you are not clear what your pension amount is currently, we can help estimate it for you. We have many years of experience working with these formulas and we understand how to incorporate and minimize your age penalties.

The AT&T Pension Benefit Plan is a defined benefit pension plan sponsored by AT&T. They have various pension plans based on different groups of employees. Today we’ll be discussing the pension plans specifically for Management and Craft. These are different plans but overall both plans behave similarly.

Benefits under the plan are provided through separate programs. A program is a portion of the plan that provides benefits to a particular group of participants or beneficiaries. Your plan is one of these:

Start the Pension Benefit process (if applicable):

When you are ready to begin receiving your pension benefit, contact the Fidelity Service Center or go to access.att.com > Retiree, Former Employee or Dependent > Login > Fidelity. You may get started up to 180 days in advance of your benefit start date.

Craft & Management Employee Defined Benefit Plan

For Craft:

- Defined Benefit using Pension bands

For Management, use the greater of:

- Cash Balance Account

- Started 1997

- Grandfathered Plan

- Hired before March 1997 and partially frozen in May 2002

- CAM Pension Plan

- Not a supplement

- Paid as a Lump Sum and/or an Annuity

- Hired after March 15th 2001. Eligible after three years

NOTE: If the difference between the amount of the single life monthly annuity for the CAM benefit and the highest applicable formula (Grandfathered) other than the CAM benefit is:

- Greater than $400 (benefit is paid as a full lump sum or a partial lump sum with a residual annuity)

- Less than $400 (benefit is paid as a lump sum)

- You may receive a partial lump sum & a residual annuity ($400 Rule)

Disclaimer: AT&T contains many different groups of employees that are provided with differing pension plan formulas and payout options. The following is information that pertains to Craft & Management Defined Benefit Plans.

There are many different plans available from AT&T. We will outline how the Craft & Management pension plans work because the majority of employees fall under these plans. Let’s take a look at a timeline example for Joe Smith:

In 1990, Joe is hired by AT&T and participates in the Craft Pension Plan:

Craft Pension Plan

- Craft has a defined benefit plan that uses pension bands.

- A pension band determines your benefits based on your job title/grade level/occupation

- Joe will receive a monthly dollar amount into his account for each year of service

- Joe’s benefit (pension band) may change yearly

Let’s assume Joe is working as a Cable Splicing Technician and is in Pension Band 120. He is interested in retiring this year, in 2021 and wants to calculate his Craft Pension benefit.

While this formula calculates a monthly pension benefit, you can determine the lump sum equivalent by using the annuity to lump sum conversion table on Fidleity’s website.

Let’s assume Joe is working and is in Pension Band 113. He is interested in retiring this year, in 2021 and wants to calculate his Craft Pension benefit.

Bargained Pension example:

Service Representative, Pension Band=113

Monthly benefit for 2020 retirement – $59.44

Age 53 with 25 years of service – $59.44 x 25 = $1,486 a month pension benefit.

Reduction for age penalties (.5% per month x 24 months) = 12% reduction

Monthly benefit at Normal retirement = $1,486(less 12%) = $1,307.68 a month

Bargained Pension example 2:

Customer Services Technician(CST)

Monthly benefit for 2020 retirement – $71.04

Age 57 with 30 years of service – $71.04 x 30 = $2,131.20 a month pension benefit.

Note: No reduction for age penalties

Management – Cash Balance Account

In 1997 Joe Smith switches to Management and participates in the Cash Balance Account:

- After 5 years of service Joe will be fully vested with no term age penalties

- If he receives salary increases, this will affect the calculation of his final benefit

- Joe will receive his benefit in the form of a Lump Sum, upon retirement

- In May of 2002 this account type was frozen by AT&T

Now we’ll discuss CAM. This is the plan that the majority of managers fall under today. It was introduced in 2001 and is the only plan that currently isn’t frozen.

In 2001, Joe starts his CAM pension plan:

CAM Pension Plan

- Assume $0 opening balance as he came from Craft

- Joe was hired before 6/12/01 so he is fully vested and eligible immediately

- Joe’s pension benefit may decrease during his early 60’s due to life expectancy.

- (Misconception: When you hit 30 years of service pension benefit decreases)

- Early retirement discounts & penalties may apply, but not if Age 55 with 30 years, refer to table A & B (penalties credited monthly)

This is one of the only pension plan that is not currently frozen. If the past is any indication of the future, there will be a day when the company decides to freeze this plan as well. For most of you, this will be the largest pension amount you have.

Joe Smith’s Pension Plan

This is a typical/generic example for how your benefit works, however each of you have different scenarios in which hire dates, years of service, age, salary, job, and more will affect your plan.

Joe Smith Example:

Craft (1985-1997)= $1500

Cash Balance (1997-2002)= $300

CAM (2002-Present)= $2400

Since the difference between the amount of the single life monthly annuity for the CAM benefit and the highest applicable formula (Grandfathered) other than the CAM benefit is greater than $400, Joe is paid a partial lump sum & a residual annuity upon retirement.

To calculate your pension benefit follow these steps:

Step 1: Add Craft and Cash Balance and compare to CAM.

Step 2: Convert Craft and Cash Balance to Annuity and compare to CAM Annuity.

Step 3: If the CAM Annuity is $400 > than the Craft and Cash Balance annuity, the payment is a partial lump sum(Craft and CB), and an annuity of the difference between combination of Craft and CB to the CAM annuity.

“One important thing to know is that if you leave the company and come back, your NCS is not instantly credited from the day you return.“

Bridging

Are you Craft or Management? Have you taken an extended leave from the company and come back thus bridging your service? Did AT&T give you a new NCS date? Well anytime you are dealing with bridging issues, it can complicate your pension calculations. Often Fidelity will not be able to provide you a pension estimate online and you’ll have to order manual calculations.

There are various rules regarding bridging. One important thing to know is that if you leave the company and come back, your NCS is not instantly credited from the day you return. There is a waiting period until you can take credit for your years of service during your second tenure.

In terms of changing from Craft to Management, or vice versa, you will end up with two pensions and two 401(k)s. We will make sure that we maximize every account that you have and not leave anything out.

Thinking about what to do with your pension is an important part of planning for your retirement at AT&T. How should you take the Lump Sum or Annuity and when should you take it? What is best for you and your family?

Lump-Sum vs. Annuity

Retirees who are eligible for a pension are often offered the choice of whether to actually take the pension payments for life, or receive a lump-sum dollar amount for the “equivalent” value of the pension – with the idea that you could then take the money (rolling it over to an IRA), invest it, and generate your own cash flows by taking systematic withdrawals throughout retirement.

The upside of keeping the pension itself is that the payments are guaranteed to continue for life (at least to the extent that the pension plan itself remains in place and solvent and doesn’t default). Thus, whether you live 10, 20, or 30 (or more!) years in retirement, you don’t have to worry about the risk of outliving the money.

By contrast, selecting the lump-sum gives you the potential to invest, earn more growth, and potentially generate even greater retirement cash flow. Additionally, if something happens to you, any unused account balance will be available to a surviving spouse or heirs. However, if you fail to invest the funds for sufficient growth, there’s a danger that the money could run out altogether, and that you may regret not having held onto the pension’s “income for life” guarantee.

Ultimately, though, whether it is really a “risk” to outlive the guaranteed lifetime payments that the pension offers, by taking a lump-sum, depends on what kind of return must be generated on that lump-sum to replicate the payments. After all, if the reality is that it would only take a return of 1% to 2% on that lump sum to create the same pension cash flows for a lifetime, there is little risk that you will outlive the lump-sum even if you withdraw from it for life(10). However, if the pension payments can only be replaced with a higher and much riskier rate of return, there’s a greater risk those returns won’t manifest and you could run out of money.

“Something else to keep in mind is that current interest rates, as well as your life expectancy at retirement, have an impact on lump sum payout options of defined benefit pension plans.“

Interest Rates and Life Expectancy

In many defined benefit plans, like the AT&T pension plan, current and future retirees are offered a lump-sum payout or a monthly pension benefit. Sometimes these plans have billions of dollars worth of unfunded pension liabilities, and in order to get the liability off the books, they offer a lump-sum.

Depending on life expectancy, the initial lump-sum is typically less money than regular pension payments over a normal retirement time frame. However, most individuals that opt for the lump-sum plan to invest the majority of the proceeds, as most of the funds aren’t needed immediately after retirement.

Something else to keep in mind is that current interest rates, as well as your life expectancy at retirement, have an impact on lump sum payout options of defined benefit pension plans. Lump sum payouts are typically higher in a low interest rate environment, but be careful because lumps sums decrease in a rising interest rate environment.

Additionally, projected pension lump sum benefits for active employees will often decrease as an employee ages and their life expectancy decreases. This can potentially be a detriment of continuing to work, so it is important that you run your pension numbers often and thoroughly understand the timing issues. Other factors such as income needs, need for survivor benefits, and tax liabilities often dictate the decision to take the lump-sum over the annuity option on the pension.

Sources:

- The Retirement Group or www.theretirementgroup.com

- “Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2019, www.dol.gov/general/topic/retirement.

- “Generating Income That Will Last throughout Retirement.” Fidelity, 22 Jan. 2019, www.fidelity.com/viewpoints/retirement/income-that-can-last-lifetime.

- AT&T Nonbargained Summary Plan Description, 2017