Envision this: You’re an AT&T employee work in Alabama, and you're about to retire. Before your last moments at the company, you have to make one last important decision. What AT&T pension benefit works best for you? You should know that you have a few options ahead of you. For your pension benefits, you can choose from a lump sum, a monthly pension, or a combination of the two (depending on how you classify, whether you are management, union, etc.).

You can also expect your AT&T pension plan to be a major income source throughout your retirement, so there's a lot to consider. Don't worry though, while pension plans can be complicated and difficult to understand, every AT&T employee faces this choice when retiring.

Of course, the choice for you will vary depending on your circumstance, since there is not one, right decision. So, your choice should be considered carefully.

To help you decide on your pension plan, we've supplied the most important factors for your decision below. This information will help you better understand your AT&T pension plan, and guide you to making the best decision possible. In addition, we strongly advise you to partner with an AT&T-focused financial advisor, so that they can help you determine what choice is right for you and your financial needs.

Sponsored Ad

How AT&T Calculates Your Pension

When AT&T calculates your pension, they use three different factors to determine your benefits:

1. Years of Service

2. Pension Band (in the case of union employees only)

3. Income Level

The higher you score in each of these sections, the greater your pension benefit will be.

While you will qualify for vesting in your pension benefit when you complete five years of service with AT&T, your pension benefit will be harmed if you do not meet the service and/or age requirements (which is dependent on your employment position). Also, you may need a reduced pension benefit if you receive your pension before age 55 (unless you are a union employee with 30 or more years of service for AT&T.

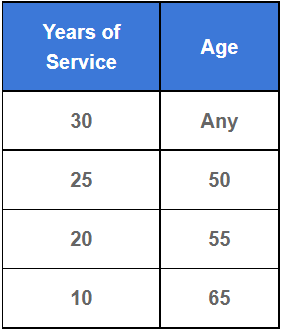

AT&T Pension Plan: Modified Rule of 75

AT&T retires can also qualify to receive medical benefits. These benefits are subsidized as long as you reach the modified 75-point rule. The modified 75-point rule is the combination of your required years of service and your age, which usually totals 75. You can see the required years of service, and age standards in the chart below.

Keep in mind though that you must meet both minimum requirements, otherwise you won't qualify. This can be confusing, as not every combination of 75 points is applicable to AT&T’s medical benefit guidelines.

For example, assuming you have completed 24 years of service, and that you're 51 years old, you would not be eligible because you do not meet both of the requirements, even though the sum of 24 and 51 yields 75.

AT&T Vested Pension vs. Service Pension

In addition to medical benefits, you are also eligible for vesting in your AT&T pension plan at the time of: a) having completed five years of service as a bargained employee, three years of service as a management employee, or b) turning 65 years of age, while still employed by AT&T, whichever is later. You'll qualify for a vesting pension when you have reached either of these requirements.

In contrast, service pensions are earned by long-term AT&T employees. You'll qualify for a service pension if you a) completed 30 years of service, or b) met the modified rule of 75, which usually states that you must meet outlined age and service year requirements, adding up to 75 years.

AT&T Vested Pension Options

The reality is that the majority of AT&T employees don't stay at the company long enough to earn a service pension. Rather, they receive a vested pension. If you're receiving a vested pension, you have a decision to make. You can either:

- Receive it before age 65 but at a significant discount. The discount on your pension will be decided by factors such as your age when you received the pension.

Or

- Defer it until you are 65 years of age

You should consider that your AT&T pension will probably be a major source of income throughout your retirement. This is why it's often recommended that you defer it until age 65 so that you can receive your full benefits. In order to do this, arrange to begin receiving your pension payout on your 65th birthday. Also, understand that delaying your pension past the age of 65 will not yield you any additional benefits.

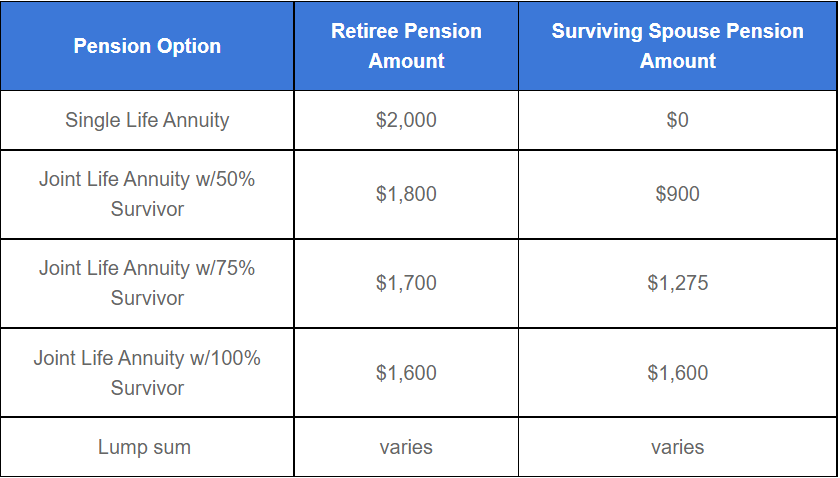

AT&T Pension Plan: Survivor Benefits

Survivor benefits are one of the most significant availabilities of the AT&T pension plan. Survivor benefits become available if an employee passes away before retiring. A spouse and only a spouse will automatically receive half of the monthly pension annuity or the lump sum equivalent.

Once the former employee has retired, they will have multiple survivor options to choose from for their monthly pension annuity (or a full lump sum if you're a union employee). However, all of these options are only available for a spouse.

If you're a management employee, you're able to choose to receive a partial lump-sum pension and a residual monthly annuity.

The chart below displays an example of these options, assuming a $2,000 single life annuity pension:

AT&T Pension Plan: Monthly Pension vs. Lump Sum

Once you reach retirement, your choices become plentiful. Employees can receive a monthly payout, like a traditional pension. Union and management employees can choose to convert all or some, respectively, of their pension into a lump-sum benefit. This can then be rolled over into an IRA (Individual Retirement Account), and then fully managed by the retiree. Just know that factors such as interest rates and life expectancy are used to calculate the lump-sum payment amount.

Both payout options have their benefits and faults, but deciding to receive your pension as a monthly annuity or a lump sum is a choice that requires thoughtful consideration. This can be best done with the guidance of a financial professional, who will consider all aspects of your financial life - Social security, 401(k) savings, and other sources of income into your decision.

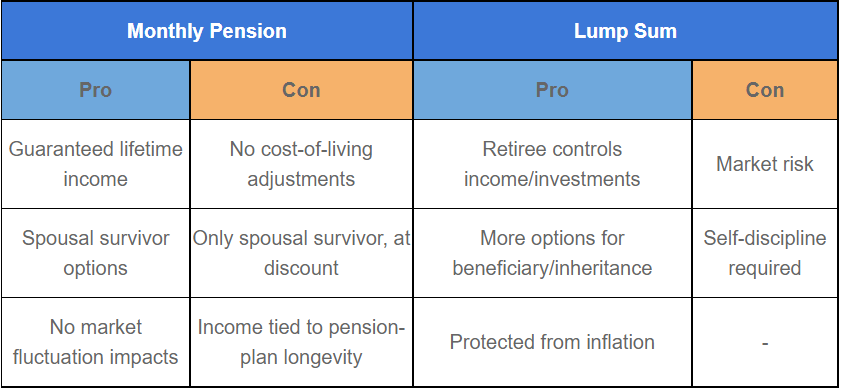

Here are some key considerations when comparing a lump sum and monthly annuity:

How Interest Rates Impact Your AT&T Pension Lump Sums

When AT&T calculates your pension benefit they use the Composite Corporate Bond Rate. This is a figure that the IRS publishes on a monthly basis. On any given year, the rate published the previous November is what AT&T utilizes for your pension commencement.

In regards, to interest rates and lump-sum payouts, the two share an inverse proportional relationship. That means when interest rates increase, AT&T pension lump sums decrease and vice versa.

Where to Find AT&T Pension Information

Working with AT&T employees for more than 30 years, we consider ourselves experts on all things related to AT&T retirement benefits. While we are experienced financial professionals, you may want to have some of your questions answered directly by AT&T affiliates. We'll be able to send you in the right direction. So, if you require personal AT&T pension or benefit information, here is where to find it:

The Retirement Group administers the AT&T pension plan and 401(k). They are able to provide people with pension estimates, 401(k) balances, and more. AT&T employees can also modify their beneficiaries through The Retirement Group.

Sponsored Ad